Starting a business, whether big or small, requires looking into all sorts of financial details such as investment, expenditure, savings etc. It can be quite easy to unintentionally mix business and personal finances in such a scenario that could be detrimental to the long-term success of your business. Therefore, it’s important to open a bank account dedicated to your small business which will help you manage your financial transactions and ensure operational continuity.

When it comes to choosing a bank that would be a good fit for your small business in Kenya, it can be a daunting process given the numerous options available in the market. Indeed, all kinds of banks operate in Kenya offering a diverse range of financial products and services. One consideration is choosing an Islamic bank that is compliant with Shariah banking principles as there are certain key advantages compared to using a conventional bank.

Here are 5 things to look for when choosing an Islamic bank for your small business in Kenya:

The Bank’s Financial Strength

It’s important to conduct thorough research on the Islamic banks that you are considering. Find out how well capitalized the bank is as well as how profitable it is on an annual basis. These two are important factors because they determine how resilient the bank will be in the event of a challenging financial scenario in the marketplace which is essential for the financial security of your business. Do also find out for how long the bank has been operating and what their overall business philosophy is for their customers. Finally, find out how they work with small businesses and their success stories from this perspective.

The Services Offered

After finding out the bank’s reputation, you then need to know if they would be the right fit for your small business. What are the services that they offer to small businesses from an Islamic banking perspective? How easy is it for a small business like yours to access these services? Try to also get a sense of their service levels and how fast or easy it is to reach them should you need solutions to a business problem. It may also help if the Islamic bank has a good physical and digital footprint, as well as affiliations or strong partnerships as this makes it easier to expand the footprint for your business.

Access to Digital Banking

Ever since we all experienced the global COVID-19 pandemic, businesses and consumers have had to adopt a digital-first approach, across the board. Therefore, you need to pick an Islamic bank that has good digital banking capabilities such as mobile banking and internet banking to ensure your SME can access funds in this ‘next normal’. Being able to access digital banking channels will enable you to check your account balance from any location, conduct money transfers, and get your bank statements from anywhere, anytime. Look out for the different mobile banking apps and the likes that will make your work easier.

Review Banking Charges

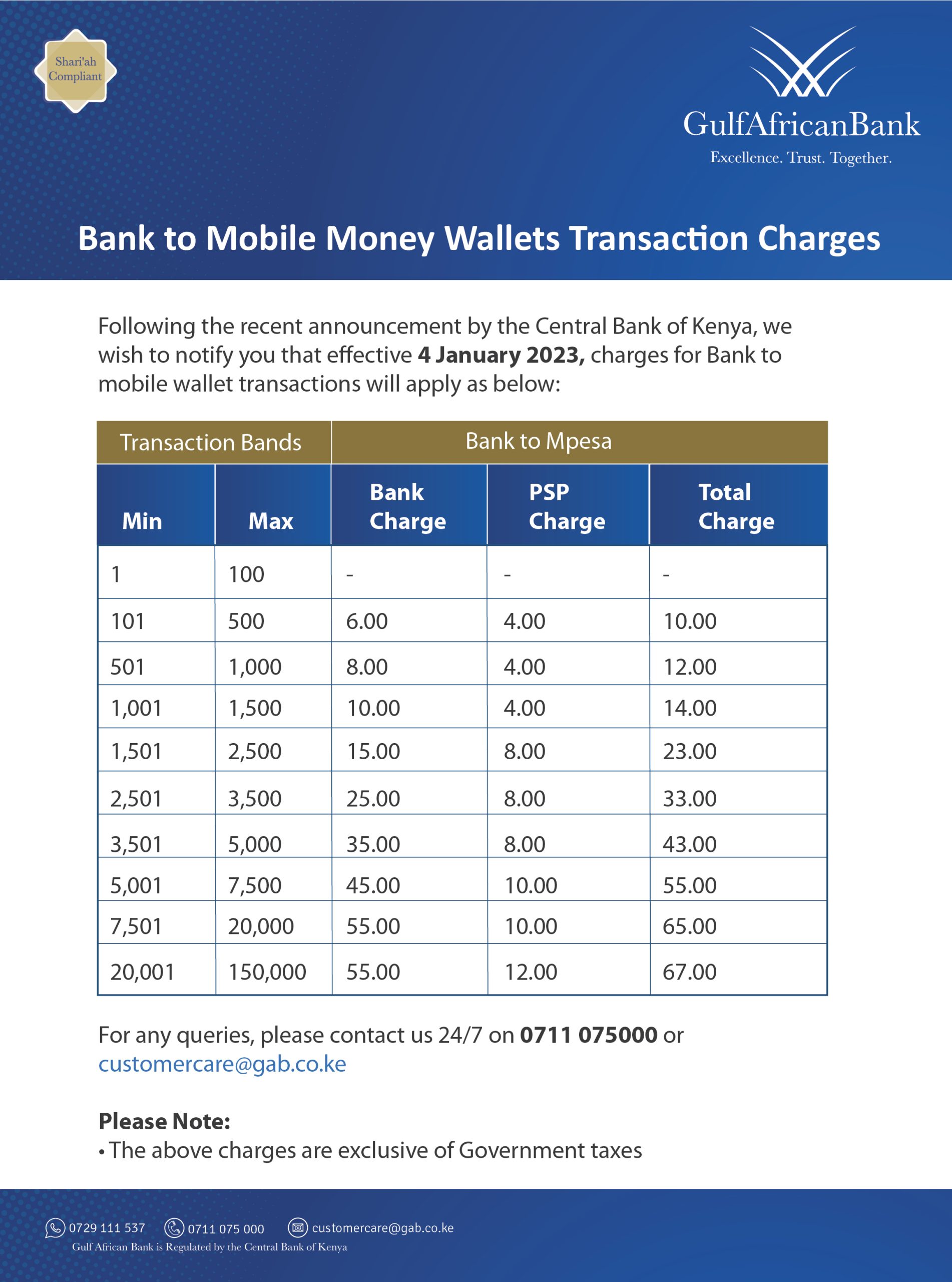

Banks typically have variable costs when it comes to delivering their products and services to their customers and quite often we may overlook these yet they can be a significant factor to the total cost of using the bank. However, as a small business owner, you cannot afford to do so because every shilling counts towards the bottom-line. Therefore, always ensure you review banking charges from the various Islamic banks in the market to see what will work for your small business. Some banks will give you the same services for lower charges. Consider for instance how much you may pay for your ATM card, for withdrawals and for money transfers to keep any banking charges at a minimum.

Debit and credit Card Flexibility

At some point, as your small business starts to grow, you will most probably need cards that offer you the flexibility to pay for your goods and services in stores and online using them. Always consider an Islamic bank that will offer you Shariah compliant cards. Shariah compliant credit cards for instance are known to offer their users benefits like zero compound fees, no interest, fair pricing, buy now pay later functionalities, availing free cards for user’s family members and so much more.

If you’re a small business looking for an Islamic bank that ticks all the boxes in terms meeting your needs, consider us at Gulf African Bank. We have been serving small businesses in Kenya for over a decade since we commenced operations. We are Kenya’s premier Islamic bank that is fully Shariah-compliant with an extensive nationwide branch network, a diverse range of superior banking products and services, as well as state of the art digital bank offerings for small businesses. Get in touch with us today and experience next level Islamic banking for Kenya!