Making the decision to buy or invest in a home is a big step for anyone in their life and making the right choices in this process is really important. Owning a home means you have a valuable asset from which you can benefit financially with the security of never having to pay rent again for the roof over your head. The journey to home ownership can be one of the most exciting for you and your family when the time comes and having the right bank as a partner is priceless!

Buying or building a home is a major undertaking from a financial perspective for anyone so being able to access financing from a bank can ease the load considerably. Buying or building a home that typically costs millions of shillings is something that most people can’t pay for lump sum. This is where a bank can help by financing your home purchase for you so that you repay them in monthly installments for an agreed period of time.

The majority of banks in Kenya have a broad range of home financing products and services through mortgages or loans that are tailored to the needs of their customers. As it turns out, conventional banks and Islamic banks have different approaches on how they deliver their home financing services to the marketplace. Indeed, here are five things consider when you are ready to make the homeownership leap and need to apply for a home mortgage in Kenya:

Explore Your Options

Banks, whether conventional or Islamic, offer a variety of home financing options. Fortunately, we live in a world where key insights about all these options are easily accessible via the internet. Keep in mind that home financing is usually bigger than other types of financing you may need from a bank. Therefore, make an effort to extensively research your home mortgage options. Find out as much as you can about down payments, equated monthly installments (EMIs) as well as the repayment tenure the various banks offer. Prior knowledge about these three factors that constitute any kind of home financing will help you find the best fit for your home financing needs.

Affordable Repayment Terms

After looking into available home financing options, you will need to pick an option that you can actually afford. Can you make the fixed monthly repayments and still meet your other monthly financial commitments comfortably? Consider your cost of living and the overhead expenses that go beyond the EMI you have chosen to pay. You will also need to have some money in savings in the event of any unexpected emergencies. It’s only natural to want a house in a location you consider perfect, in a design you’ve always dreamt of. However, remember affordability is always key and you never want to overextend yourself.

Home Finance Eligibility

Home finance eligibility criteria vary from one bank to another. However, there are basic requirements that all prospective homeowners must meet to access home financing. Some banks will usually have this criteria posted on their websites while for others, you may have to visit one of their branches in person to make inquiries. Whatever the case, it’s really important that you pre-check your eligibility for home financing before applying. Typical criteria could include things such as your debt to income ratio which should be convincing enough to lenders that you can actually make repayments. It could also include your employment history, which should demonstrate employment track record through the years or some type of security.

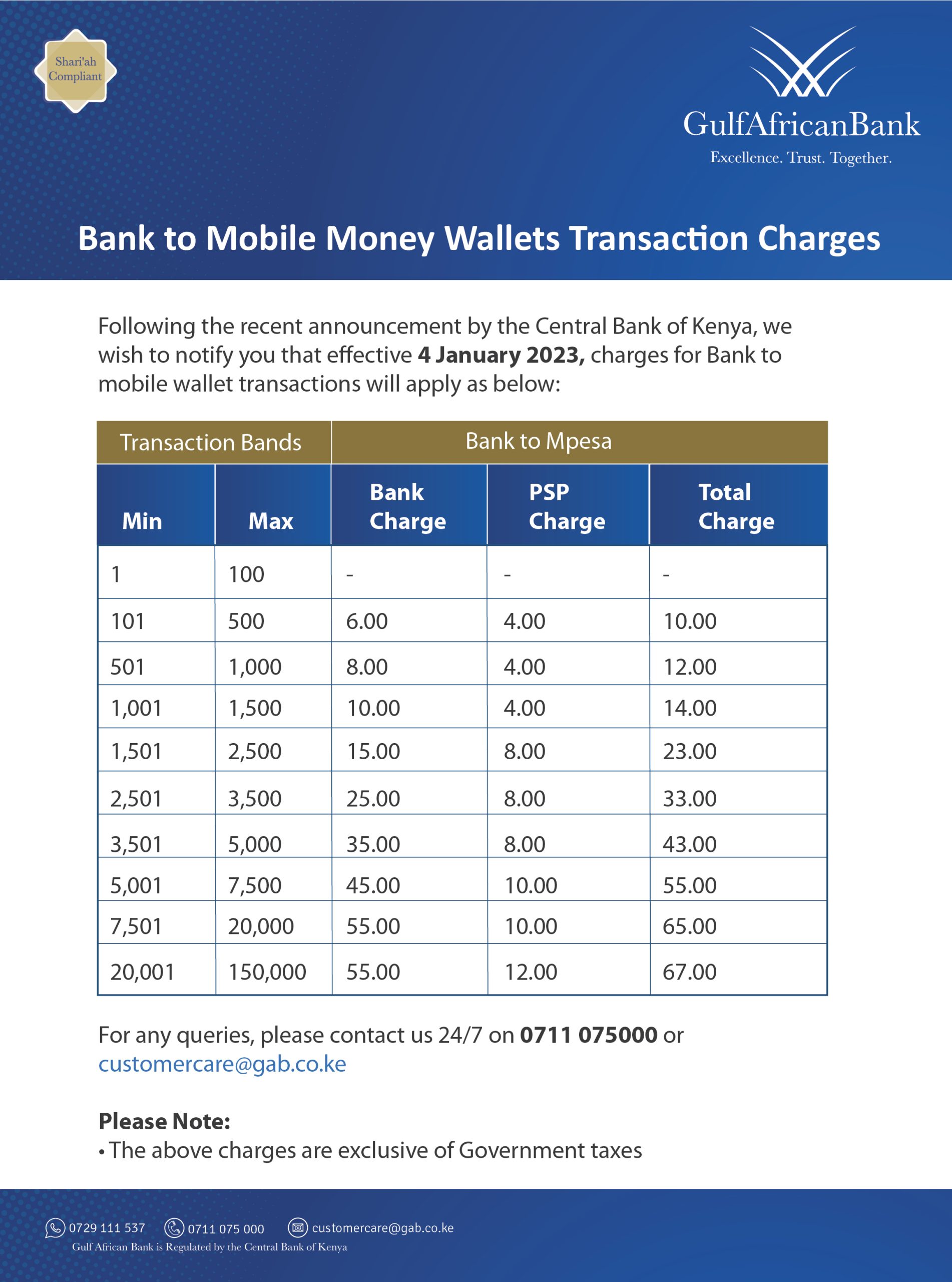

Additional Charges

In addition to the monthly installments required once you get your home financing, lenders may in some cases include additional charges. These could cover administration, processing of the home financing, the service charge levied at the time of your application, amongst others. Ensure that you check whether they are one-time charges or if you will be required to pay these on a monthly basis. This will ensure you plan your finances accordingly with each passing month.

Foreclosure Terms

You should also consider certain norms that could be an added advantage to you. A great example is foreclosure terms. Foreclosing your home financing means repaying the outstanding amount within a shorter timeframe than you had committed to initially. This can be a major financial benefit for you as it can save you from paying any additional charges. You can also reduce the interest you pay on monthly installments for the home financing you got from your lender and even get a higher credit score for repaying it sooner!

If you’re in the market for a mortgage or home financing in Kenya, Gulf African Bank can be the partner you need to make your dream of homeownership come true! We have a diverse range of affordable home financing solutions that are Shariah Compliant and in accordance with the Diminishing Musharaka Shariah agreement. We also offer highly flexible home finance repayment plans that will ensure you maintain your lifestyle even as you take this major step towards owning a home for you and your family. Wherever you may want your home to be in Kenya, contact us today and we’ll get you started!